[ad_1]

A SpaceX rocket launched Thursday carrying Intuitive Machines’ Nova-C moon lander. (Credit: Reuters/NASA)

Texas-based Intuitive Machines landed a spacecraft on the moon last Thursday, and despite making it to the lunar surface, the lander tipped over, sending shares of the company tumbling with it after the news broke.

Intuitive Machines (LUNR.O) was the first private company to successfully land on the moon last week, causing its stocks to nearly double from $4.98 before Odysseus was launched on Feb. 15, to $9.59 at the close of the market on Friday.

But a late-day sell-off sent the price tumbling by 30% after learning the spacecraft had tipped over onto its side.

The company noted that Odysseus is “alive and well,” adding that engineers were sending commands to the vehicle. NASA officials praised Intuitive Machines’ efforts during a press conference after the event.

US SUCCESSFULLY LANDS ON MOON FOR FIRST TIME IN HALF-CENTURY WITH PRIVATE ROBOT SPACECRAFT

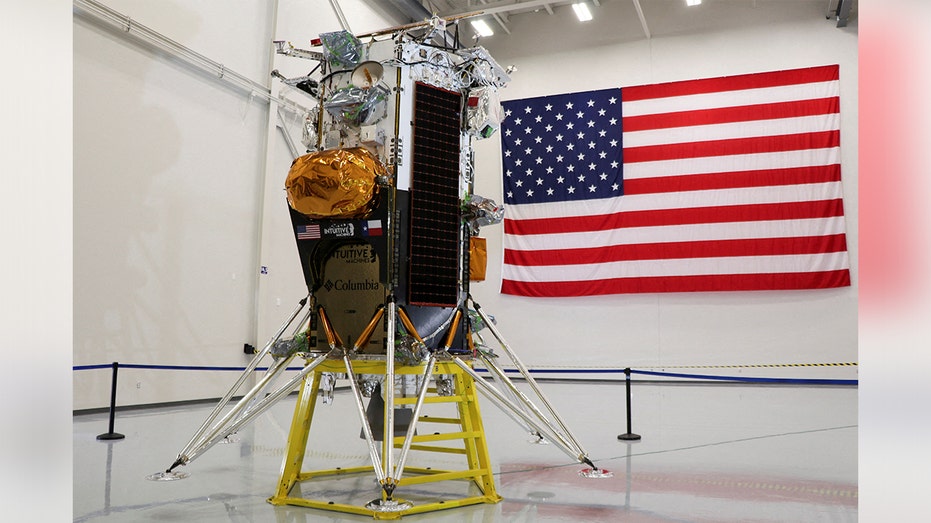

The Nova-C lunar lander designed by aerospace company Intuitive Machines is displayed at the company’s headquarters in Houston, Texas, U.S., October 3, 2023. (REUTERS/Evan Garcia/File Photo / Reuters Photos)

Last Thursday, the U.S. witnessed the company’s nearly successful mission when the lander touched down near Malapert A in the South Pole region of the moon.

The touchdown marked the first time an American spacecraft had landed on the moon since the last crewed Apollo mission over 50 years ago. The last time an American spacecraft touched down on the moon was in 1972, during the Apollo 17 mission.

The lunar lander touched the moon’s surface at 6:24 p.m. ET on Thursday, and although it was believed to be on the moon, the signal being transmitted by the equipment was lost.

CELLPHONE OUTAGE HITS AT&T CUSTOMERS NATIONWIDE; VERIZON AND T-MOBILE USERS ALSO AFFECTED

A SpaceX Falcon 9 rocket is on top of the Nova-C lander which launched into space on Feb. 15, 2024. (REUTERS/Joe Skipper/ File photo / Reuters Photos)

After about 15 minutes, the signal returned, though faint.

“We’re not dead yet,” Mission Director Tim Crain said, telling the team the equipment was on the surface of the moon and transmitting. The condition and orientation of the equipment, though, was still unknown.

Reaching the moon’s surface after more than half a century enthused investors of fellow space startups, sending shares of companies like Astra Space (ASTR.O) and Satellogic (SATL.O) on the rise. During afterhours trading, the shares slipped between 0.5% and 2.8%.

Intuitive Machines CEO Stephen Altemus said Odysseus was believed to have caught one of its six landing feet on the lunar surface during its final descent and tipped over, coming to rest on its side, and propped up on a rock.

Altemus added that teams were obtaining the first photo images from the lunar surface at the landing site.

SPACEX ROCKET BLASTS OFF CARRYING INTUITIVE MACHINES’ MOON LANDER

A SpaceX Falcon 9 rocket lifts off from launch pad LC-39A at the Kennedy Space Center with the Intuitive Machines’ Nova-C moon lander mission, in Cape Canaveral, Florida, on Thursday, Feb. 15, 2024. (Gregg Newton/AFP via Getty Images / Getty Images)

All but one of the payloads were facing upwards and expected to conduct their scientific objectives, company executives said. The one piece not facing upwards was an art piece.

Intuitive Machines did not immediately respond to inquiries from Fox News Digital.

Even though the enthusiasm of a successful mission pushed Intuitive Machines’ stock market value near $1 billion, just 18% of the shares are available for trading because most of the stocks are held by insiders and major investors, according to London Stock Exchange (LSEG) data. When over $850 million worth of the company’s shares exchanged on Friday, it made for a massive turnover for a single session.

A SpaceX Falcon 9 rocket carried Odysseus from Florida shortly after 1 a.m. on Feb. 15, to the moon. The launch unfolded after a lunar lander from Astrobotic Technology encountered propulsion difficulties during a mission in January and failed to reach the moon.

CLICK HERE TO READ MORE ON FOX BUSINESS

The uncrewed spacecraft had been circling the moon about 57 miles above the surface since reaching orbit on Wednesday and remained “in excellent health” while roughly 239,000 miles from Earth, transmitting flight data and lunar images to Intuitive Machines’ mission control center in Houston, the company told Reuters.

NASA said in a statement that the instruments onboard the lander “will conduct scientific research and demonstrate technologies to help us better understand the Moon’s environment and improve landing precision and safety in the challenging conditions of the lunar south polar region, paving the way for future Artemis astronaut missions.”

FOX Business’ Greg Norman and Reuters contributed to this report.

FARRATA NEWS Online News Portal

FARRATA NEWS Online News Portal