[ad_1]

Payne Capital Management President Ryan Payne and University of Akron Endowment Committee Chair Dennis Gartman discuss the U.S. economy as investors await Fed Chair Jerome Powell’s speech.

The Federal Reserve left rates unchanged at its latest meeting this week, but its aggressive rate-hiking campaign over the past 16 months has left borrowing rates for consumers higher than they have been in years.

Here is a look at where interest rates are hovering for home mortgages, credit cards and auto loans:

Home loans

Homes under construction in Sacramento, California, US, on Monday, July 3, 2023. The average interest rate for the benchmark 30-year fixed-rate is the highest its been in two decades. (David Paul Morris/Bloomberg via Getty Images / Getty Images)

According to the latest data from Freddie Mac, the average rate for a 30-year, fixed-rate mortgage is 7.18%, the highest level in two decades and more than three points higher than a year ago. Pre-pandemic, the average for the benchmark rate was at 3.9%.

FED SKIPS AN INTEREST RATE HIKE, BUT HIGH MORTGAGE RATES COULD BE HERE TO STAY

Credit cards

The average credit card interest rate is upwards of 20%. (Robert Nickelsberg/Getty Images / Getty Images)

A report from the Fed released earlier this month shows the average credit card interest rate as of the second quarter was 20.68%, which is more than 5% higher than it was the same quarter in 2022.

AVERAGE MONTHLY MORTGAGE PAYMENT AT NEAR ALL-TIME HIGH

Auto loans

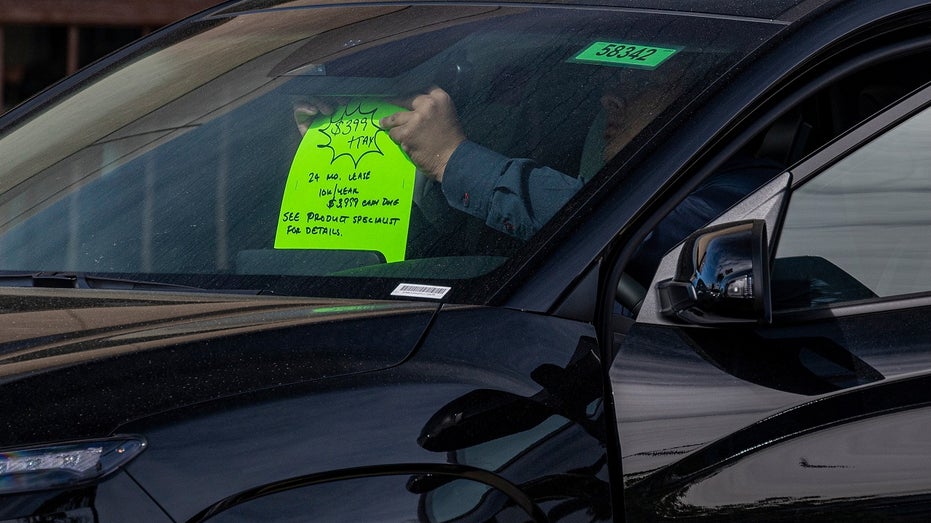

A dealer puts up a sign in a used car for sale at a dealership in Richmond, California, US, on Tuesday, Feb. 21, 2023. The Federal Reserve’s aggressive campaign to fight inflation is driving up interest rates for borrowing, including on auto loans. (Photographer: David Paul Morris/Bloomberg via Getty Images / Getty Images)

According to a recent report from Market Watch, the latest data from credit scoring agency Experian shows the average auto loan for a new vehicle was 6.63% in the first quarter and for used vehicles, buyers took on average interest rates of 11.38%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Fed hinted Wednesday that it could impose another rate hike this year.

FOX Business’ Megan Henney contributed to this report.

FARRATA NEWS Online News Portal

FARRATA NEWS Online News Portal